SBI Health Insurance

SBI Health Insurance truly reflects the legacy & trust of the brand SBI among Indian policyholders. They offer expertly curated health plans for i...Read More

SBI Health Insurance truly reflects the legacy & trust of the brand SBI among Indian policyholders. They offer expertly curated health plans for individuals, families & senior citizens. With great customer support, over 6000 networking hospitals, efficient claim support and others, SBI Health Insurance promises you the best health protection!

Buy Policy in Just 2 Mins

2 Lakh+ Happy Customers

Network hospitals

6000+

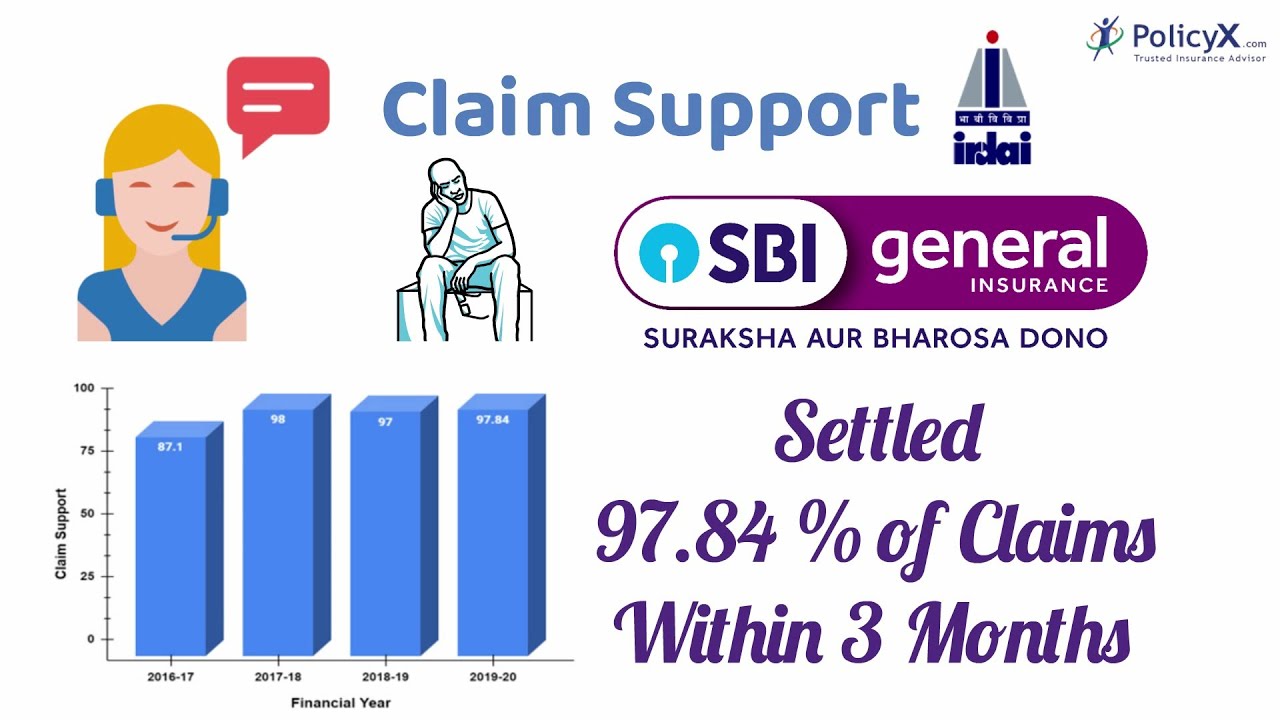

Claim settlement ratio

98%%

Sum insured

Up to 2 Cr

No. of Plans

12Solvency Ratio

1.8

Pan India Presence

141+

PolicyX Exclusive Benefits

Buy Policy in just 2 mins

With expert guidance from advisors

2 lakh + Happy Customers

Real-time reviews on Google

Free Comparison

Find the best policy for you

Health and Term Insurance

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By:

Insurance & Business

Naval Goel, the founder of PolicyX is a well-recognised name in the Indian insurance and finance industry. His global overview has revolutionised the way insurance is perceived and bought by commoners in India.

Updated on Aug 07, 2023 4 min read

Term Insurance, Content Writer

Content Manager with heart, mind, and soul dedicated to creating impactful content that exceeds the market standard, delivers and reaches the readers conveniently. Besides producing high-ranking content, my focus lies in creating content that solves user queries and adds value.

Written By: Himanshu Kumar

Updated on Jan 15, 2025

Term Insurance, Content Manager

Content Manager with heart, mind, and soul dedicated to creating impactful content that exceeds the market standard, delivers and reaches the readers conveniently. Besides producing high-ranking content, my focus lies in creating content that solves user queries and adds value.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

15 min read

SBI Health Insurance: An Overview

In the year 2009, your bank, State Bank of India collaborated with the Insurance Australia Group (IAG) and created SBI Health Insurance in the health segment. SBI General is one of the fastest growing private general insurance companies having SBI as the parent company. They carry forward the legacy of trust and security and envision becoming the most trusted general insurer for transforming India. As a health care insurance provider, they have served over 34 crore customers till now.

What does SBI General Insurance Do?

SBI Health Insurance is the health segment that belongs to the SBI General Insurance Company. They offer several health insurance plans that come with complete health coverage to individuals, senior citizens, and families. You can make payments in the premiums and claim the amount in case of any emergency.

Some Interesting Facts About SBI Health Insurance Company

- SBI General Insurance has some multi-distribution models like bancassurance, agency, broking, retail direct channels, and digital tie-ups.

- They value transparency, empathy, and agility.

- Their claim settlement ratio is 95.04%.

- There are add-on covers available under several health insurance plans for enhanced coverage.

- Their claim settlement process is superfast and they have settled more than Rs 110 billion claims till now.

What are some of the

Features

that set them apart?

-

1

Special health plans for autism and diabetes

-

2

A comprehensive wellness system to promote a healthy lifestyle

-

3

Emergency air ambulance services

-

4

International travel for treatments

-

5

Unlimited teleconsultations

SBI Health Insurance Awards and Accolades.

- Customer Experience Innovator Company of the Year.

- Best Claim Settlement in Non-Life Category at Insurance Next Awards.

- Asia's Best General Insurance Company for rural presence.

- Ranked Number 1 under General Insurance by YouGov Finance Purchase Rankings.

- Insurer of the year in Non-Life Category by FICCI Insurance.

- Customer experience innovator Company of the Year.

- Recognized for CSR Project with Learning Space Foundation.

Why Do We Exist?

Compare

Health Insurance Companies

Choose 1st Company

Choose 2nd Company

Compare

Health Insurance Companies

Best Selling SBI Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual and Family Health Insurance

SBI Health Insurance Plans Eligibility Approximate Annual Premiums SBI Super Health Insurance Policy Entry Age - Min: 91 Days, Max: No Limit

Sum Insured - Up to 2 CrRs. NA

SBI Health Edge Policy Entry Age - 18 to 65 Years

Sum Insured - Up to 25 LRs. 6305

-

Group Health Insurance

SBI Health Insurance Plans Eligibility Approximate Annual Premiums SBI Group Health Insurance Entry Age - 18 to 65 years

Sum Insured - Up to 5 LRs. NA

-

Individual

SBI Health Insurance Plans Eligibility Approximate Annual Premiums SBI Loan Insurance Policy Entry Age - 18 years to 65 years

Sum Insured - Up to 1 CroreRs. NA

SBI Hospital Daily Cash Insurance Plan Entry Age - 18 to 65 Years

Sum Insured - Up to Up to 4000Rs. 335

-

Critical Illness Health Insurance

SBI Health Insurance Plans Eligibility Approximate Annual Premiums SBI Critical Illness Policy Entry Age - 5 years to No maximum age limit

Sum Insured - Up to 10 LRs. 357

Key Features Of SBI Health Insurance

Let us take a look at some unique features of top-selling SBI Health Insurance policies:

For Individual and Family Health Insurance

-

SBI Super Health Insurance Policy

-

SBI Health Edge Policy

-

SBI Arogya Supreme Policy

-

SBI Arogya Sanjeevani Policy

-

SBI Arogya Top-Up Policy

-

Arogya Plus Policy

-

Arogya Premier Policy

SBI Super Health Insurance Policy

SBI Super Health Insurance provides 27 base covers and 7 optional covers, with sum insured options ranging from INR 3 lac to INR 2 Crore. The major benefits of SBI Super Health Insurance include re-insure benefits, health multiplier benefits, and more.

Why do we recommend this?

- Wellness Benefit

- Renewal Benefits

- Annual Health Check-up

SBI Health Edge Policy

The comprehensive health insurance plan, SBI Health Edge has 9 basic indemnity covers and 18 optional covers that provide extended healthcare support to the policyholders.

Why Do We Recommend This?

- Avail Bariatric Surgery cover

- Emergency road ambulance cover

- Avail of health check-ups

SBI Arogya Supreme Policy

SBI Arogya Supreme health plan provides a solution for all your healthcare needs. It covers 20 basic covers and 8 optional covers to bear your medical treatments and expenses.

Why Do We Recommend This?

- Domestic Air Ambulance Cover

- Compassionate Benefit

- Recovery Benefit

SBI Arogya Sanjeevani Policy

Comprehensive health insurance policy that covers basic to advanced healthcare expenses, ranging from in-patient hospitalization to pre and post-hospitalization care.

Why Do We Recommend This?

- Deep Brain Stimulation, Balloon Sinuplasty

- Intra Vitreal Injection expenses

- Avail Oral Chemotherapy cover

SBI Arogya Top-Up Policy

This top-up policy is designed to provide additional coverage to policyholders when their standard health policy coverage is exhausted. The plan adds an extra shield of protection at affordable premiums.

Why Do We Recommend This?

- Organ donor expenses

- Pre & post hospitalisation

- In-patient hospitalisation

Arogya Plus Policy

This policy has been created to cover the most essential clinical aspects required in the process of recovery for an individual. It comes with a lifelong renewal benefit as well.

Why Do We Recommend This?

- High sum insured for extended benefits

- Available for you and your family

- AYUSH treatment cover

Arogya Premier Policy

SBI Arogya Premier Policy is a comprehensive health insurance plan that is designed to protect you and your family from uncertain medical expenses.

Why Do We Recommend This?

- Genetic disorders and internal congenital diseases

- No pre-policy medical tests required

- Avail coverage for mental illness

For Group Health Insurance

-

SBI Group Health Insurance

SBI Group Health Insurance

SBI Group Health Insurance is a comprehensive plan, as it provides wider coverage to its customers as well as their family members.

Why Do We Recommend This?

- Avail in-patient hospitalization

- Daycare treatments cover

- Avail renewal benefits

For Individual

-

SBI Loan Insurance Policy

-

SBI Hospital Daily Cash Insurance Plan

-

SBI Divyanga Suraksha Policy

SBI Loan Insurance Policy

SBI Loan Insurance policy offers comprehensive coverage to the policyholder and helps them to repay their loan in case of accidental/critical illness medical emergencies, leading to job loss or death.

Why Do We Recommend This?

- Covers 13 critical illnesses

- Pays out the outstanding loan amount or sum insured

- Pays out the maximum of 3 EMIs

SBI Hospital Daily Cash Insurance Plan

SBI Hospital Daily Cash insurance policy takes care of the extra expenses related to hospitalisation which are generally excluded from your basic health policy.

Why Do We Recommend This?

- Consumables cover

- Food cover

- Transportation cover

SBI Divyanga Suraksha Policy

SBI Divyanga Suraksha health plan is specially designed for people with certified disability/disabilities according to the Rights of Persons with Disabilities Act of 2016, India.

Why Do We Recommend This?

- Pre and post-hospitalization

- Daycare procedures

- Modern treatment cover

For Critical Illness Health Insurance

-

SBI Critical Illness Policy

SBI Critical Illness Policy

SBI Critical Illness Insurance Policy offers you financial protection from 13 important critical illnesses, this policy offers a fixed sum, irrespective of your actual medical expenses.

Why Do We Recommend This?

- Avail cover for 13 critical illnesses

- Emergency air ambulance service

- COVID-19 coverage is available

Explore other SBI Health Insurance

To cater to the different medical needs of an individual & their family, SBI Health Insurance offers several Health Plans ranging from senior citizen plans to specialized plans for autistic children, to health insurance for cardiac patients, and many more. Take a look below to SBI Health Insurance plans explore more:

Individual and Family Health Insurance

SBI Super Health Plan is SBI Health Insurance's new comprehensive health insurance plan. The plan is an umbrella health plan that provides all-inclusi...

Unique Features

- Unlimited Re-insure Benefit

- Wellness Benefits

- Annual Health Check-ups

SBI Super Health Insurance Policy (Pros)

- Tax benefit

- Reinsure benefit

- Health multiplier

- Optional covers

SBI Super Health Insurance Policy (Cons)

- Cosmetic treatment

- Injury due to illegal activities

- Unlawful activities

- Adventure sports injuries

SBI Super Health Insurance Policy (Other Benefits)

- OPD expenses

- International treatment

- SI up to 2 Crores

- Flexible premium payments

SBI Super Health Insurance Policy (Eligibility Criteria)

- Min entry age: 18 Years

- Max entry age: 65 Years

- Initial Waiting Period: 30 Days

- Sum Insured: Up to 2 Cr

Individual and Family Health Insurance

SBI Health Edge is a newly introduced health insurance plan from SBI Health Insurance which is customizable and is available to insurance holders base...

Unique Features

- Avail Global Treatment

- Multiple Discounts

- 18 Optional Covers

SBI Health Edge Policy (Pros)

- In-patient hospitalization

- Pre and Post-hospitalization

- Daycare treatments

- Emergency ambulance cover

SBI Health Edge Policy (Cons)

- Organ donor

- Compassionate visit

- Domiciliary hospitalization

SBI Health Edge Policy (Other Benefits)

- Bariatric Surgery Cover

- Modern Treatments

- AYUSH Treatments

- Health Check-ups

SBI Health Edge Policy (Eligibility Criteria)

- Entry Age: 18 to 65 Years

- SI: 3 to 25 Lakhs

- Initial waiting period: 30 days

Group Health Insurance

SBI Group Health Insurance is a comprehensive plan, as it provides wider coverage to its customers as well as their family members. Group health insur...

Unique Features

- High Sum Insured

- Easy Policy Renewal

- 10% copayment

SBI Group Health Insurance (Pros)

- In-patient hospitalization

- Daycare treatments

- Co-payment clause

SBI Group Health Insurance (Cons)

- Room rent unavailable

- OPD not covered

- Organ donor expenses

- Modern treatment unavailable

SBI Group Health Insurance (Other Benefits)

- Ambulance expenses

- Pre & post-hospitalisation

- Policy renewal benefits

SBI Group Health Insurance (Eligibility Criteria)

- Entry age: 18 to 65 years

- Sum insured: 1 to 5 Lakhs

- Initial waiting period: 30 days

Individual and Family Health Insurance

SBI Arogya Supreme health plan is a diverse health insurance plan that provides a solution for all your healthcare needs. It covers 20 basic covers an...

Unique Features

- Complete protection

- Choose SI

- Choose policy tenure

SBI Arogya Supreme Policy (Pros)

- Domestic Air Ambulance Cover

- Compassionate Benefit

- Recovery Benefit

SBI Arogya Supreme Policy (Cons)

- Automatic restoration

- Maternity cover unavailable

- Newborn baby cover

- 2nd medical opinion not covered

SBI Arogya Supreme Policy (Other Benefits)

- E-Opinion Cover

- Preventive Health Check-up

- Renewal Benefit

SBI Arogya Supreme Policy (Eligibility Criteria)

- Entry age: 18 to 65 years

- Sum Insured 3 L | 5 L | 7.5 L | 10 L | 15 L | 30 L | 40 L | 50 L | 1 Cr

- Policy Term 1/2/3 Years

- Initial Waiting Period 30 Days

Individual

SBI Loan Insurance policy offers comprehensive coverage to the policyholder and helps them to repay their loan in case of medical emergencies arising ...

Unique Features

- Loan repayment benefits

- Plan details

- Inclusions and exclusions

SBI Loan Insurance Policy (Pros)

- Pays out max 3 EMIs

- Pays outstanding loan

- PTD benefits

SBI Loan Insurance Policy (Cons)

- Drug abuse or alcoholism

- HIV/AIDS

- Self-inflicted injury

SBI Loan Insurance Policy (Other Benefits)

- Accidental cover

- Critical illnesses cover

- Loss of job cover

SBI Loan Insurance Policy (Eligibility Criteria)

- Entry Age: 18 to 65 years

- SI: 1 Crore

- Initial waiting period: 90 days

Critical Illness Health Insurance

SBI Critical Illness Insurance Policy offers you financial protection from 13 important critical illnesses, this policy offers a fixed sum, irrespect...

Unique Features

- Coverage for Cancer

- Eligibility Criteria

- Inclusions and Exclusions

SBI Critical Illness Policy (Pros)

- 13 critical illnesses

- COVID- 19 covered

- Air ambulance services

SBI Critical Illness Policy (Cons)

- Maternity cover

- OPD and daycare unavailable

- Global cover unavailable

SBI Critical Illness Policy (Other Benefits)

- Emergency medical cover

- No Maximum age limit

- SI up to 10 L

SBI Critical Illness Policy (Eligibility Criteria)

- Entry age: 5 years to No limit

- SI: 3 to 10 Lakhs

- Initial waiting period: 90 days

Individual and Family Health Insurance

SBI Arogya Sanjeevani Policy is a standard health insurance policy that comes with an affordable premium and offers a bucket full of benefits to its p...

Unique Features

- Affordable Health Plan

- Eligibility Criteria

- Inclusions and Exclusions

SBI Arogya Sanjeevani Policy (Pros)

- In-patient hospitalization

- Pre and post-hospitalization care

- ICU expenses

- Daycare treatment

- Up to 12 advanced treatments

SBI Arogya Sanjeevani Policy (Cons)

- Modern treatment unavailable

- OPD not covered

- Domiciliary hospitalization unavailable

SBI Arogya Sanjeevani Policy (Other Benefits)

- Deep Brain Stimulation

- Balloon Sinuplasty

- Oral Chemotherapy

- Intra Vitreal Injections

SBI Arogya Sanjeevani Policy (Eligibility Criteria)

- Entry Age: 18 to 65 Years

- SI: 50K to 1 Lakhs

- Initial waiting period: 30 days

Individual and Family Health Insurance

SBI Arogya Top-up Policy is a health insurance top-up policy that is designed to provide additional coverage to policyholders when their standard heal...

Unique Features

- Enhanced coverage

- Eligibility criteria

- Key features

SBI Arogya Top-Up Policy (Pros)

- In-patient hospitalisation

- Pre & post hospitalisation

- Ambulance cover

SBI Arogya Top-Up Policy (Cons)

- Global coverage

- Air ambulance

- Compassionate visit

- OPD cover unavailable

SBI Arogya Top-Up Policy (Other Benefits)

- Organ donor expenses

- Domiciliary treatment

- Modern treatment

SBI Arogya Top-Up Policy (Eligibility Criteria)

- Entry age: 3 months to 65 years

- SI: 1 to 50 Lakhs

- Policy term: 1/2/3 years

- Initial waiting period: 30 days

Individual and Family Health Insurance

SBI Arogya Plus policy is a fixed premium plan that offers financial protection to you and your family during a medical emergency. The plan provides c...

Unique Features

- What is Arogya Plus?

- Know the Eligibility Criteria

- Premiums Sample Illustration

Arogya Plus Policy (Pros)

- OPD cover

- In-patient hospitalization

- Pre & post hospitalization

Arogya Plus Policy (Cons)

- Newborn baby cover

- Vaccination

- Compassionate travel

- Organ donor cover unavailable

Arogya Plus Policy (Other Benefits)

- AYUSH treatment

- Domiciliary hospitalization

- HIV/AIDS cover

- Mental illness cover

Arogya Plus Policy (Eligibility Criteria)

- Entry Age: 3 Months to 65 Years

- Sum Insured: 1/2/3 L

- Policy term: 1/2/3 years

- Initial waiting period: 30 days

Individual and Family Health Insurance

SBI Arogya Premier Policy is a comprehensive health insurance plan that is designed to protect you and your family from uncertain medical expenses. Th...

Unique Features

- Plan Specifications

- Eligibility

- Inclusions and Exclusions

Arogya Premier Policy (Pros)

- In-patient hospitalization expenses

- Pre and post-hospitalization

- AYUSH treatments

- Maternity expenses

Arogya Premier Policy (Cons)

- Daily hospital cash cover

- Newborn baby cover

- Global coverage

- Compassionate visit unavailable

Arogya Premier Policy (Other Benefits)

- Mental illness cover

- HIV/AIDS cover

- Internal congenital diseases

- Genetic disorders

Arogya Premier Policy (Eligibility Criteria)

- Entry Age: 3 Months to 65 Year

- Sum Insured: 10 to 30 Lakhs

- Initial Waiting Period: 30 days

Individual

Manage Additional Expenses With Hospital Daily Cash Insurance of SBI! SBI Hospital Daily Cash insurance policy takes care of the extra expenses ...

Unique Features

- Daily cash benefit

- Convalescence expenses

- No medical check-up required

SBI Hospital Daily Cash Insurance Plan (Pros)

- Daily cash benefit

- Convalescence benefit

- Multiple plan options

SBI Hospital Daily Cash Insurance Plan (Cons)

- Illegal activities

- Alcoholism

- Obesity

SBI Hospital Daily Cash Insurance Plan (Other Benefits)

- Hospitalization benefits

- ICU hospitalization

- Affordable premiums

SBI Hospital Daily Cash Insurance Plan (Eligibility Criteria)

- Min entry age: 18 Years

- Max entry age: 65 Years

- Initial Waiting Period: 30 Days

- Sum Insured: Up to 2 K

Individual

Would you believe if we say that the SBI Divyanga Suraksha health insurance plan provides healthcare for people with disability or any pre-existing HI...

Unique Features

- Covers in-patient treatment

- HIV/AIDS cover

- Power against disability

SBI Divyanga Suraksha Policy (Pros)

- Pre and post-hospitalization

- Medical treatment

- Daycare procedures

- Cataract cover

SBI Divyanga Suraksha Policy (Cons)

- Domiciliary hospitalization

- Vaccination

- Health check-ups

- Global coverage

SBI Divyanga Suraksha Policy (Other Benefits)

- Modern treatment cover

- In-patient treatment

- AYUSH care

- PEDs cover

SBI Divyanga Suraksha Policy (Eligibility Criteria)

- Entry age: 18 o 65 years

- SI: 4 & 5 Lakhs

- Initial Waiting Period: 30 days

Recommended Videos

SBI Health Insurance

SBI Health Insurance Plan 2024

Why Choose SBI Health Insurance?

- Trusted brand with loyal customers

- A wide network of hospitals

- Cashless anywhere even in non-network hospitals

- Additional healthcare cover

- Dedicated customer support

- Efficient claim support

What is Covered?

Pre and Post Hospitalization Expenses

SBI Health Insurance helps fight against rising medical expenses, with their health insurance including pre and post-hospitalization expenses related to in-patient hospitalization.

AYUSH Treatments

Most SBI Health Insurance plans have in-built alternative treatment cover which you can utilize to your benefit. AYUSH treatments include Ayurveda, Unani, Siddha, and Homeopathy treatments.

Hospitalization Expenses

SBI health insurance plans cover your hospital expenses like room rent, ICU charges, surgery expenses, doctor consultations, and other such expenses.

Day Care Treatments

Multiple procedures do not require a 24-hour hospitalization. With this in mind, a majority of the SBI health insurance plans are designed to cover daycare procedures for policyholders.

Domiciliary Hospitalization

On a doctor’s recommendation, a policyholder can avail of medical care in the comfort of their home. SBI health insurance plans cover domiciliary hospitalization up to specified sub-limits.

What is not Covered?

Self Inflicted Injuries

SBI health policies will not cover injuries or hospitalization caused by self-harm.

Cosmetic Procedures

SBI Health Insurance plans do not cover any kinds of cosmetic surgeries or treatments.

Adventure Sports

SBI Health Insurance plans will not cover you for hospitalizations, or accidents caused due to adventure sports.

Obesity or Weight Control Treatments

SBI Health Insurance plans mostly do not cover treatments related to obesity and weight management such as bariatric surgeries.

Involvement In Illegal Activities

SBI health insurance company plans do not cover individuals or families for hospitalization or injuries caused due to unlawful activities.

What Are The Different Waiting Periods In SBI Health Insurance Plans?

The various waiting periods associated with SBI Health Insurance plans are:

Initial Waiting Period

Begins from the date of purchase and lasts for up to 30 days for most SBI Health Insurance plans.

Pre-existing Disease Waiting Period

As per IRDAI, pre-existing diseases are diseases that are diagnosed 1 month before you buy a health insurance plan. Diseases like diabetes, thyroid, hypertension, etc are some of the diseases in which waiting periods might occur. However, this waiting period does not apply to the group insurance.

Mental Illness Waiting Period

Today, many policies provide coverage for mental illness but you can avail claim after a specific time. Usually, the waiting period for mental illness coverage is 1 to 4 years.

Maternity Waiting Period

Maternity benefits usually start after 1 to 4 years of waiting period after buying health insurance. However, it depends upon the policy. So, you need to plan your family accordingly.

SBI Health Insurance Network Hospital List

SBI Health Insurance Network Hospitals are present in 31 states nationwide. With a wide network of hospitals, SBI Health Insurance ensures that you are medically secured, irrespective of the city you reside in.

SBI Health Insurance Plans Buying Process

If you are looking forward to purchasing SBI Health insurance online follow the simple steps below:

- Step 1

Visit the PolicyX health insurance page, and enter your details such as name, age, number of members to be covered, and city.

- Step 2

Click on 'Get free quotes' and compare SBI Health Insurance Plans as per your needs.

- Step 3

Select and pay premiums online for the purchased SBI health insurance plan of your choice.

- Step 4

Our team of insurance experts at PolicyX will provide you with all the assistance required regarding claims and other queries post-purchase of your SBI Health Insurance plan.

SBI Health Insurance Renewal Process

Follow the steps for SBI Health Insurance policy renewal

- Step 1

Visit the official website of SBI Health Insurance Company

- Step 2

Click on the ‘Renew’ tab

- Step 3

Mention your ‘Policy Number’ and ‘Date Of Birth’

Connect with our insurance experts for SBI health insurance policy renewal at 1800-4200-269

SBI Health Insurance Plan Claim Process Steps

You can file for cashless as well as reimbursement claims for your SBI Health Insurance Plans by following these easy steps:

- Step 1

Visit the website of SBI Health Insurance, and select the "Claim" option. Then click on the "Claim Intimation" to check out the form.

- Step 2

Now select "health claim" and require the information which is the policy number, date of birth, and other details they ask for.

- Step 3

Now select the "claim type", whether you want to opt for a cashless claim or reimbursement. Click on the authorize and you will receive the OTP on the verified number.

- Step 4

Get verified with the OTP and fill in the required hospital admission information, select the hospital, and fill in the hospital details in case of a non-network hospital.

- Step 5

Upload the documents asked and click on the "review" button.

- Step 6

After clicking on the review button you need to submit the intimation for the company to review. You will receive a claim intimation number which you need to note down for future purposes.

Documents Required For SBI Health Policy Claim Settlement

Submit the following documents when filing for SBI health claims:

- Duly completed and signed claim form, in original

- Valid photo-ID proof

- Medical practitioner's referral letter and prescription

- Original bills, receipts, and discharge cards from the hospital/medical practitioner

- Original bills from pharmacy/chemists

- Original pathological/diagnostic tests reports/radiology reports and payment receipts

- Indoor case papers

- First Information Report, final police report, if applicable

- Post-mortem report, if conducted

- Any other document as required by the company to assess the claim

How To Port To SBI Health Insurance?

To port your existing policy to SBI Health Insurance, follow the steps mentioned below:

- Step 1

Fill out the portability form, and send the application to SBI Health Insurance Company 45 days before the date of your existing health plan renewal.

- Step 2

As per the guidelines of IRDAI, the new insurance company will cross-check your medical and claims history from the previous insurer within 7 days of receiving the portability form.

- Step 3

Once the policyholder's details are verified, the new insurance company has to communicate its decision - either approval or rejection - within 15 days.

How To Calculate SBI Health Insurance Policy Premiums?

Compare and calculate the best SBI health policies with the PolicyX premium calculator with these simple steps:

- Step 1

Visit the official website of 'PolicyX'

- Step 2

Fill in details such as name, number of family members to be covered, city, and other information

- Step 3

Click on 'Get Quotes'

P.S - Connect with PolicyX health insurance experts for SBI health insurance policy premiums enquiry at 1800-4200-269

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Explore SBI Health Insurance

SBI Health Insurance: FAQs

1. How many days are taken by the SBI General Insurance company to settle a health insurance claim?

The company will settle all admissible claims within 30 days of receipt of the final survey report.

2. Do we get rewards points for staying healthy in SBI Health Insurance plans?

No, SBI health insurance does not provide reward points for staying healthy.

3. Am I eligible to receive tax benefits under SBI Health Insurance?

Yes, policyholders are eligible for tax benefits under Section 80D of the Income Tax Act, 1961.

4. What do you mean by Co-payment? Is there any co-pay clause in this SBI Health Insurance plan?

Co-payment is the amount that the policyholder has to pay for the medical service covered under the health insurance plan. SBI health insurance plans co-pay clause based on the geographical region of the hospitalization (between 20-30%). In addition, if you are admitted to a non-network hospital, you will be required to pay a 10% copayment.

5. What is the policy cancellation process for SBI health insurance?

SBI medical insurance offers a 15 day free-look period to the policyholders in which you can cancel your policy free of cost.

6. How to pay a premium? What are the modes of payment offered by SBI medical insurance?

You can pay the premium of the SBI health insurance plans online or by visiting your nearest SBI health insurance branch. The policyholder can make an online payment using the following payment modes: Credit card Debit card Net banking UPI

7. What is the maximum policy tenure of the SBI health insurance policy?

SBI mediclaim policy comes with a policy term of up to 3 years.

8. Is there any age limit for buying a health insurance policy from SBI General, and what’s the maximum tenure available?

The minimum age for buying individual health insurance policies from SBI General is 18 years, and the maximum is 65 years, although children as young as 3 months can be covered under health insurance policies if both parents are enrolled under the same plan.

9. What are the renewal formalities for SBI General Health Insurance?

Renewal premium has to be paid with the understanding that no new information has become available concerning the first policy filings. In case the insured has contracted an illness during the last 12 months, the same has to be notified to the insurer as new illnesses may require payment of an extra premium.

10. What is covered in SBI family health insurance plans?

SBI family health insurance plans include hospitalization expenses, pre and post hospitalization coverage, OPD and day care, maternity costs, ambulance charges, AYUSH, and medical health care.

11. Can I buy SBI health insurance plans online?

Yes, SBI health insurance plans are available online.

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Health Insurance Articles

Filing Reimbursement Mediclaim Mar, 2025

Health Insurance for HIV Patients Mar, 2025

Health Insurance for a New Born Baby Feb, 2025

GST on Health Insurance Feb, 2025

IRDAI’s New Launch: Bima ASBA Feb, 2025

See More Health Insurance Articles

Married Couple Health Insurance Sep, 2024

Group Health Plan Eligibility Sep, 2024

Dental Insurance Aug, 2024

Apply for Ayushman Bharat Sep, 2024

See More Health Insurance Articles

Share your Valuable Feedback

4.4

Rated by 2636 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

You May Also Know About

No Gimmicks, No Spam.

Genuine Advice from an Insurance Expert.

✖

✖

Talk To An Advisor

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

Insurance Experts

No Gimmicks

- No Spam

- No Mis-Selling

- No Pushy Sales

Talk to an advisor

- 13 Febuary 2023, 4:00PM

Consult with Expert Advisor

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

Are you sure you want to exit?

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Confirmed

Your call has been scheduled with Policyx for health insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?